Return Inwards Debit or Credit

The NEFT clearing centre sorts fund transfer destination-wise and prepare to account entries to receive funds from the originating banks debit and give credit the funds to the designated bank. It is a sales return and on the other it.

What Is Return Inwards And Return Outwards Quora

And you can get a Curve card for free.

. Accounting software like TallyPrime is designed to ensure that debit and credit always match at the time of recording the transaction itself. A ledger is the actual account head to identify your transactions and are used in all accounting vouchers. They are goods that were once purchased from external parties however because of being unsatisfactory they were returned back to them they are also called Purchase returns.

Related Topic Accounts Payable with Journal Entries Credit Note. Cheque photocopy less than 1 year. Link your existing credit debit cards to the app.

Returned outward clearing cheques Personal Free. To printing and. Credit or debit cards were not yet widely used.

And after that bank-wise remittance messages are forwarded to the destination bank through their pooling centre NEFT Service Centre. The accounting records will show the following bookkeeping entries for the sales return of inventory. The balance goes straight onto one of your existing debit or credit cards.

Return outwards are goods returned by a customer to the seller. 105 105 per instance. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

Without a ledger you cannot record any transaction. From the bank column on the debit side of the Cash Book. Kidman September 20 Sales SJ01 104400 September 30 Return Inwards RI01 9600 September 30 Balance cd 94800 104400 104400 October 1 Balance bd 94800 B.

Banton September 13 Sales SJ01 78550 September 24 Return Inwards RI01 16800 September 29 Discount Allowed CB01 6175 29 Cash CB01 55575 78550 78550 Page 03 Page 02 20. From the cash column on the debit side of the Cash Book. Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more.

Debit Note is an instrument or document which is given by the buyer or purchaser of the goods and services to the seller. Losses Depreciation Return inwards Profit and loss Ac Dr Bad debts etc. Enter your details theyll send you a Curve MasterCard - they send to most European addresses including the UK.

Profit and Loss Account Format. The customer account gets a credit entry and the sales return Sales Return The term sales return is used in payroll journal entry to account for customer returns in the books of account or to account for when a customer returns goods sold owing to defect goods sold or misfit in the customers requirement etc. When a Seller receives goods returned from the buyer he prepares and sends a credit note as an intimation to the buyer showing that the money for the related goods is being returned in the form of a credit note.

The profit and loss account starts with gross profit at the credit side and if there is a gross loss it is shown on the debit side. Be informed and get ahead with. Special Clearing - Inward.

Read more becomes a debit Debit Debit represents either an. To Gross profit bd. You can alter any information of the ledger master with the except for the closing balance under the group s tock-in-hand.

A credit note is sent to inform about the credit. To office rent rates and taxes. If you get a loan to buy a car the bank credits your current account and you then write a cheque use a credit or debit card or initiate a bank transfer to the car dealer to buy the car.

Sales returns Return inwards Total sales returns from the Return Inwards Day book Sales returns journal. Cheque return - Inward Return Reason Represent after 3 working days for every item responded. The entries about the Freight inwards are posted on the debit side of the trading account whereas the entries about the carriage outwards are posted on the credit side of an income statement Income Statement The income statement is one of the companys financial reports that summarizes all of the companys revenues and expenses over time in order to.

The debit note is issued by the purchaser against the seller to inform him that the goods or services have been returned and now the seller is debited against the purchaser to the sum of goods and supplies return. Journal Entry for a Sales Return. Outward returns reduce the total accounts payable for a business.

Cheque photocopy over 1 year. Journal Entry for a Sales Return. For example purchase payments sales receipts and others accounts heads are ledger accounts.

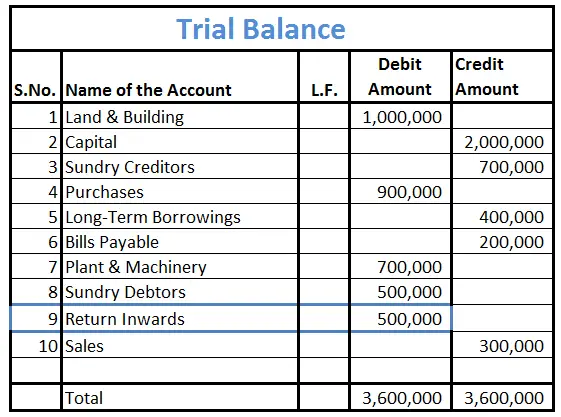

Total of the Discount column on the debit side of the Cash book. Particulars Intrialbalance Reason Capital Credit Loan Opening stock Debit Asset Purchases Debit Expenses Sales Credit Gain Return inwards Debit Loss Return outwards Credit Gain Wages Debit Expenses Freight Debit Expenses Transport expenses Debit Expenses Royalties on production Debit Expenses Gas fuel Debit Expenses Discount received Credit Revenue. Today a debit card works by instantly verifying the balance of your bank account and debiting from it.

Download the app for iPhone or Android. A sales return sometimes called a returns inwards is recorded in the accounting records as follows. Thus matching of the trial balance is a Thing of Past and the traditional need for someone to depend on trial balance is eradicated.

Sample Format of a Debit Note. Enter the email address you signed up with and well email you a reset link. To Gross loss bd.

How Is Return Inwards Treated In Trial Balance Accounting Capital

What Are Return Inwards Example Journal Entry Accounting Capital

How Is Return Inwards Treated In Trial Balance Accounting Capital

No comments for "Return Inwards Debit or Credit"

Post a Comment